The NYSCRF Emerging Manager Program is one of the largest and most closely watched initiatives of its kind, offering promising and often underrepresented investment firms a pathway to institutional capital.

For many emerging fund managers, securing a place in this program can be a pivotal step toward long-term growth and credibility.

Led by Sylvester McClearn, the program has committed more than $10.9 billion across multiple asset classes, giving managers the opportunity to prove their performance and potentially graduate into larger, direct mandates with the New York State Common Retirement Fund.

Opening Doors for New Talent

Created to broaden access to institutional investment opportunities, the NYSCRF Emerging Manager Program supports managers in public and private equity, fixed income, real estate, real assets, and credit strategies. According to the Fund, seventeen managers have advanced from the program to direct mandates in its core portfolio.

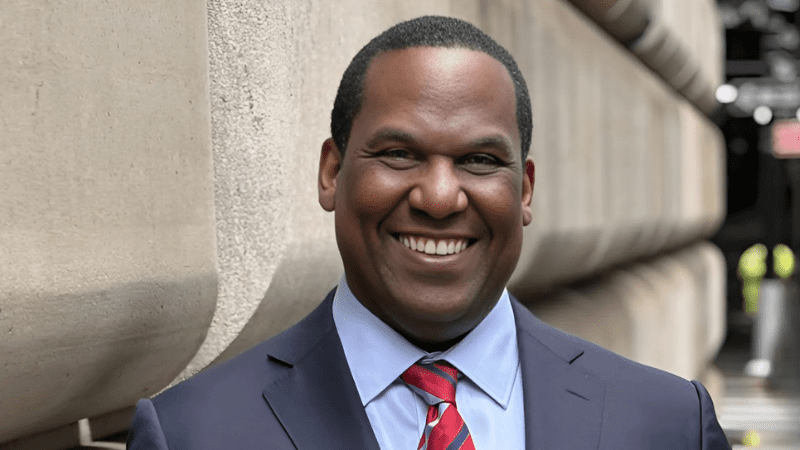

The Man at the Helm

McClearn became Director of the Emerging Manager Program in February 2024, after serving as Interim Director for a year. His career spans more than two decades on Wall Street, with leadership roles at CastleOak Securities, Loop Capital Markets, Citi, and Topeka Capital Markets.

At NYSCRF, his work extends beyond managing allocations. He focuses on identifying and partnering with managers who can deliver strong returns while expanding the definition of who gets access to institutional capital. His oversight spans public and private markets as well as relationships with program partners who help source and support emerging managers.

A Pathway to Bigger Things

The NYSCRF model operates as a proving ground. Managers often start with smaller allocations, giving them the chance to demonstrate results without the immediate pressure of a billion-dollar mandate. Those who excel in performance, operational readiness, and relationship-building can earn larger allocations over time.

One way to connect with the Fund is through its annual Emerging Manager and MWBE Conference, which brings together allocators, consultants, and managers. While participation does not guarantee capital, it offers valuable access to decision-makers.

Why This Matters Now

Although many institutional investors have expressed a greater commitment to diversity, the share of capital flowing to diverse-owned fund managers remains disproportionately low.

Programs like the one led by McClearn create structured pathways for new and underrepresented managers to access institutional allocations.

For those who are prepared and visible, these programs can open doors that are otherwise difficult to unlock. For emerging managers, the takeaway is clear: understand your unique edge, build your network, and be ready to seize the opportunity when it comes.

Interested in investing in Black founders and fund managers?

Join our Investor List for insights and updates on today’s most promising, investment-ready founders and fund managers.