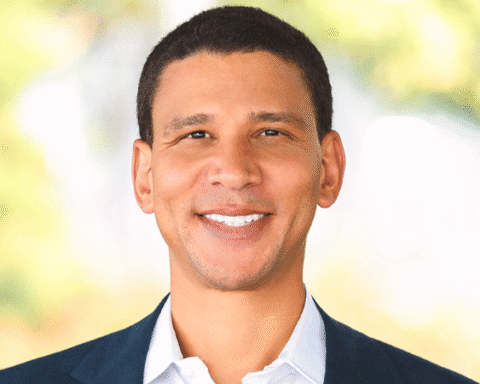

Lori Chatman leads one of the nation’s largest affordable housing finance platforms. She oversees an $18.7 billion portfolio that spans equity, debt, and tax credit investments.

As president of Enterprise Community Partners’ Capital Division, a national nonprofit focused on affordable housing and community development, she directs Enterprise Community Investment and Enterprise Community Loan Fund. In this role, she channels capital into communities where housing affordability remains among the most pressing challenges.

Equitable Path Forward: Closing Racial Gaps in Real Estate

At Enterprise, Chatman spearheaded Equitable Path Forward (EPF), a $3.5 billion, five-year initiative designed to close racial and economic gaps in real estate. The program invests directly in developers of color through flexible loans, equity, and tax credits. In addition, it provides advisory services and a peer network to strengthen long-term capacity.

Examples of Impact

One partner, Ginosko Development Company, is a Michigan-based firm with a capitalized value of more than $586 million. The company has used EPF support to advance projects that might otherwise face barriers in traditional finance. It specializes in affordable housing preservation and mixed-income developments.

Another example is New Orleans Restoration Properties, a family-run business dedicated to preserving and creating affordable housing in the city’s Hollygrove neighborhood. With support from EPF, the firm is advancing projects in partnership with the City of New Orleans and the Louisiana Housing Corporation.

Building Equity Through Access

“We’re helping people overcome the barriers that keep them from the table so they can build the future they envision for themselves and the communities they love,” Chatman has said.

Through this approach, Enterprise has already supported BIPOC-led developers across more than 20 states. As a result, thousands of affordable homes have been created in majority-Black and Brown communities.

Tools like the Standby Guaranty Facility also play an important role. This credit enhancement removes traditional balance sheet barriers. Consequently, developers can compete on larger projects and build sustainable businesses in an industry where access to capital has long been uneven.

Beyond Transactions

Chatman’s focus goes well beyond transactions. By embedding racial equity into the DNA of Enterprise’s work, she directly addresses the systemic barriers that fuel the racial wealth gap.

This positions Enterprise not just as a capital provider, but also as a partner in building more resilient, inclusive communities.

Don’t miss articles like this.