Africa is no longer just a source of elite athletic talent; it’s becoming an investment frontier for sports, entertainment, and cultural infrastructure.

With a projected market value of over $20 billion by 2035, the continent’s sports and entertainment sectors are drawing interest from institutional investors seeking long-term exposure to Africa’s expanding consumer base and creative industries.

Among the most active players is Helios Investment Partners, one of Africa’s largest private equity firms. Through its dedicated vehicle, the Helios Sports & Entertainment Group (HSEG), the firm is investing across media rights, live events, venue development, and hospitality.

In June 2025, Helios secured a $50 million equity investment into HSEG, led by the International Finance Corporation (IFC) and Proparco, with contributions of $30 million and $20 million, respectively. The capital is intended to support HSEG’s continued expansion into key verticals such as sports IP, event production, and supporting infrastructure.

Established in 2021, HSEG was created to address what Helios describes as a structural gap in Africa’s sports and entertainment sectors. While the continent boasts globally recognized talent and a growing audience, challenges around infrastructure, financing, and ownership persist.

HSEG’s current portfolio includes NBA Africa, the regional affiliate of the U.S.-based basketball organization; Professional Fighters League (PFL Africa), which is building a presence for MMA in African markets; Afro Nation (via a stake in The Malachite Group), a leading diaspora music festival platform; and Zaria Group, a hospitality and venue development company co-founded by Toronto Raptors president Masai Ujiri.

The firm’s investments reflect a broader view of sports and entertainment as drivers of adjacent sectors—including tourism, digital content, infrastructure, and employment.

One of the most prominent HSEG-backed developments is Zaria Court, a $26 million project in Kigali, Rwanda, adjacent to the BK Arena. Co-developed by HSEG and Zaria Group, the complex will include a boutique hotel, indoor and outdoor sports facilities, live performance and podcast studios, and food and beverage venues.

According to project statements, the site is expected to create more than 500 jobs and serve as a model for future urban entertainment hubs across the continent.

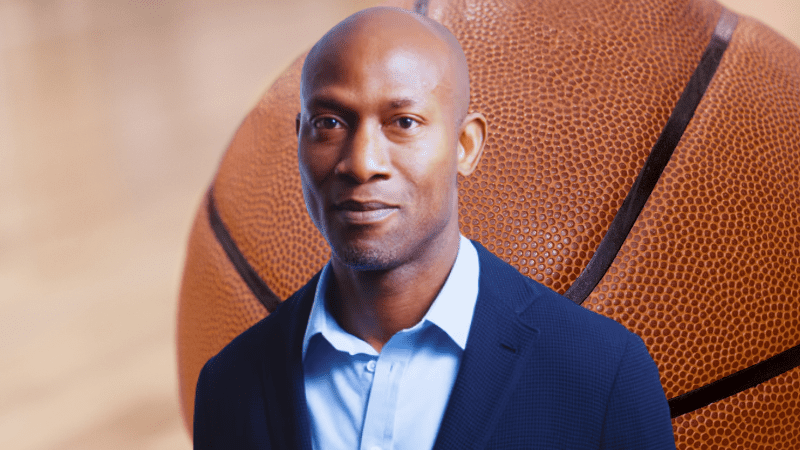

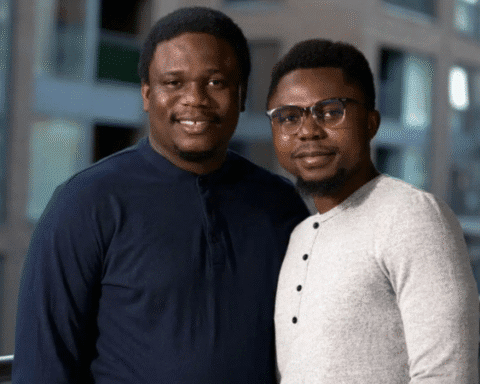

In a public statement, Tope Lawani, Managing Partner at Helios, noted the long-term demand drivers behind the platform’s strategy: “We are constantly presented with attractive opportunities driven by Africa’s richness of talent and increasingly sought-after content,” he said. “We are excited to capitalize on HSEG’s unique market position to create economic value and genuine impact.”

The IFC projects that Africa’s sports economy will nearly double by 2028, driven by population growth, urbanization, and digital adoption. However, few firms have structured their portfolios to engage the full value chain—ranging from content and IP to event venues and hospitality infrastructure.

With new capital secured, HSEG plans to expand its activities across a broader set of cities and sectors. The firm is targeting opportunities not only in sports and live events, but in related services such as merchandising, food services, and media production.

“We welcome the support from reputable institutions such as the IFC and Proparco,” Lawani said. “Their investment underscores confidence in the African creative economy and in our ability to deliver sustainable returns at scale.”

For policymakers, HSEG’s investment model offers a case study in how sports and entertainment assets can drive job creation, urban development, and regional tourism. For investors, it reflects a shift from passive exposure to active platform-building in African creative markets.

Rather than simply allocating capital to isolated opportunities, Helios is building an integrated system designed to capture value across sectors. From Johannesburg to Nairobi, the firm’s pan-African strategy centers on IP ownership, infrastructure development, and long-term institutional alignment.

Interested in investing in Black founders and fund managers? Join the Investor List