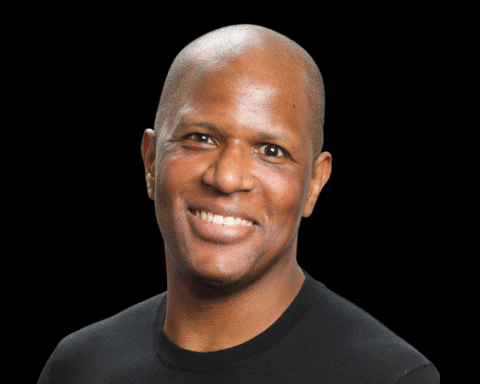

As Managing Director and Head of ESG & Sustainability at PAI Partners, Esohe Denise Odaro is helping drive the next era of responsible investing.

She has become a key voice in sustainable finance and private equity, drawing on two decades of global experience at the intersection of impact, investment, and industry standards.

Her work has earned recognition as one of the “20 Most Influential in ESG” by Private Equity News and several other accolades.

In this candid Q&A, Esohe shares her journey, her vision for the next frontier of ESG, and advice for those aiming to drive change in finance and beyond.

Your path to leadership in sustainable finance spans institutions like the World Bank Group to your current role at PAI Partners. What early experiences or mentors most shaped your commitment to purpose-driven investing?

My path didn’t begin in boardrooms or on trading floors—it started in a bustling household in Nigeria, one of seven children with nearly sixty first cousins across the diaspora.

In Benin City, on the edge of the Niger Delta, I witnessed firsthand how environmental degradation and social injustice often walk hand in hand.

Growing up in such a large, dispersed family exposed me to an incredible range of human experiences.

I saw relatives navigate everything from poverty to prosperity, persecution to opportunity. That early exposure to inequality was personal. It led me to study human rights law, hoping to advocate for those without agency.

A truly formative professional moment came during the COVID-19 pandemic.

I was in South Africa, preparing to fly to Hong Kong for a climate conference, when it became clear how serious COVID was. I rushed home to my two young kids, and suddenly, like so many, I was working from my dining table in lockdown.

Our team at the IFC faced a daunting challenge: how do you create global COVID relief through financial markets when those markets are in freefall? The answer came from grit, optimism, and a collective drive to help those in need.

We worked around the clock, and the IFC became the first to issue a global social bond during the COVID-19 crisis—on the day WHO declared a pandemic.

That $1B bond was oversubscribed more than three times, proving that purpose and profit can go hand in hand when you have the right framework and courage to act.

As Head of ESG & Sustainability at PAI Partners, what does it actually look like to integrate ESG across €27B+ in assets? How does your approach as an “Operating Partner” differ from traditional compliance models?

For me, integrating ESG across €27 billion in assets means fundamentally rewiring how we think about value creation.

At PAI Partners, my team and I are embedded in the investment process from day one—not just reviewing deals after the fact.

The old compliance model asks, “Are we meeting minimum standards?” An Operating Partner asks, “How can sustainability performance drive competitive advantage and value creation?” It’s defense vs. offense.

Practically, this means that when our deal teams evaluate a potential acquisition, I’m not just checking boxes.

I work with management teams to spot sustainability-driven growth opportunities—like supply chain optimizations that reduce costs and environmental impact, or employee engagement programs that drive retention and productivity.

We’ve developed “ESG Value Creation Plans” for our portfolio companies.

These are not generic templates but tailored strategies, recognizing that a healthcare company’s sustainability journey is very different from a consumer goods manufacturer’s.

Sustainability performance isn’t separate from business performance—it is business performance.

Where do you see the biggest gaps in how private equity and credit investors are currently approaching ESG—and what’s the next frontier for truly transformational sustainable investing?

The biggest gap is that ESG is still too often seen as risk mitigation, not value creation.

Too many firms ask, “How do we avoid ESG problems?” instead of, “How do we use ESG to unlock value?”

The next frontier is what I call “transformational sustainable investing”—where sustainability drives the entire investment thesis, not just influences it.

We’re moving beyond “sustainable versions” of traditional strategies and toward new models of value creation.

One example: we’re collaborating with lender counterparts to integrate sustainability into credit structures, aligning borrowers’ sustainability performance with their cost of capital.

That’s a powerful incentive for real change.

You sit on multiple boards and ESG committees for portfolio companies. What are the most common misconceptions leadership teams have about ESG? How do you help them move beyond “checkbox” thinking to value creation?

The biggest misconception is that ESG is a cost center, something that just satisfies external stakeholders but doesn’t create real business value.

Some management teams see ESG as more restrictions or reporting burdens.

I usually start by asking, “What keeps you up at night about your business?” The answers always touch on sustainability—talent retention, supply chain resilience, regulatory changes, customer expectations.

That’s when the lightbulb goes off: ESG isn’t an outside imposition; it’s a framework for addressing their most pressing challenges.

What advice do you have for aspiring underrepresented leaders looking to break into sustainable finance or private equity?

My advice is inspired by something I learned as a teenager, watching an interview with Run DMC.

When asked what DMC would do if he hadn’t made it in music, he said he’d be writing rhymes during downtime if he worked at a post office.

As James Clear puts it in “Atomic Habits”: whatever you do when you’re “wasting time” should be your job.

When I was an undergrad, there was no sustainability degree. My north star has always been preserving human rights, and I believe most sustainability issues have their roots there.

For aspiring leaders, especially from underrepresented backgrounds: be honest about what really interests you, then find its connection to a better future for people and the planet.

That overlap is where you’ll have the most impact.

Also, build your informal board of advisors—experts who are passionate about change and supportive of innovation.

Your network is your net worth, but more importantly, it’s your path to impact.

If you could wave a magic wand and change one thing about how global capital allocators approach ESG and impact, what would it be?

I’d eliminate the artificial line between “sustainable” and “mainstream” investing.

The idea that you must choose between financial returns and positive impact is not just false—it’s counterproductive.

Capital allocators must recognize that in a world facing climate change and social inequality, the companies best positioned for long-term success are those with sustainability at their core.

The real question isn’t whether ESG will affect returns, but whether investors will be proactive or reactive.

My vision is a world where every investment decision considers environmental and social factors—not because it’s the “right thing to do,” but because it’s the smart thing to do.

When we reach that point, there won’t be a need for separate sustainable finance frameworks; all finance will be sustainable by design.

As the Native American proverb goes: “We do not inherit the earth from our ancestors, we borrow it from our children.”

Our role as stewards of capital is to ensure that borrowing creates value for future generations—not debt.