In a $30 trillion U.S. asset management industry, less than 1% of firms are Black-owned.

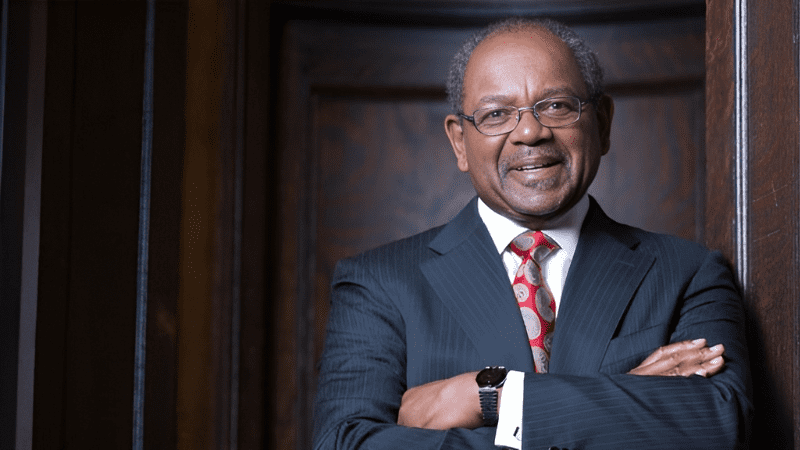

One of them was built from the ground up by Eddie C. Brown, a visionary investor who turned a fascination with the markets into a four-decade legacy.

Eddie C. Brown founded Brown Capital Management in Baltimore in 1983 after a successful career that included research and portfolio management at T. Rowe Price.

Raised in Florida by his grandmother, Brown’s journey from modest beginnings to becoming one of the most respected names in finance is chronicled in his memoir, Beating the Odds: Eddie Brown’s Investing and Life Strategies. His goal was to create a firm with a rigorous, disciplined approach to investing — one that could compete with the largest players in the world.

Today, BCM is one of the oldest and largest African American-owned asset managers in the U.S., with approximately $7.6 billion in assets under management as of mid-2025 (regulatory filings for Q4 2024 show $8.1 billion in discretionary assets).

Brown built BCM by combining disciplined stock selection with patience — holding high-quality companies through market cycles. The firm maintains a compact portfolio, invests across market caps, and avoids short-term speculation.

This consistent approach has helped BCM navigate both booming and challenging markets while staying independent for four decades.

An Approach That Stands Out

While many growth managers use similar criteria, BCM applies this approach with:

Concentrated portfolios of 40–70 holdings, giving each investment more influence on results

Low turnover, reflecting a genuine long-term perspective

Cross-cap flexibility, investing in small, mid, and large caps internationally

Recent Performance

In Q2 2025, BCM’s International All Company Fund returned 13.49%, outperforming the MSCI EAFE Index’s 12.07%. Year to date, international equities have significantly outperformed U.S. markets, benefiting clients with global allocations.

Top contributors included:

MercadoLibre — Latin America’s leading e-commerce and fintech platform, reporting 37% year-over-year revenue growth

AJ Bell — a U.K. wealth management platform with high profitability and strong customer growth

The portfolio currently allocates 33.5% to Information Technology, with notable weight in Industrials, Healthcare, and Financials.

Resilience Through Market Cycles

BCM has navigated both strong years — like 2023’s +28.36% return — and challenging ones, such as 2022’s -31.37%.

Their process emphasizes patience with high-quality companies through market cycles, a stance that is difficult to maintain in a short-term-driven industry.

A Lasting Impact

Longevity and scale are rare for any independent investment firm. For a Black-owned firm in a historically exclusionary industry, it’s even more significant.

BCM’s story is proof that disciplined investment, leadership continuity, and representation can coexist and endure at the highest levels of global finance.

Interested in investing in the future leaders of Black business and investing?

Join our Investor List for insights and updates on today’s most promising, investment-ready founders and fund managers.