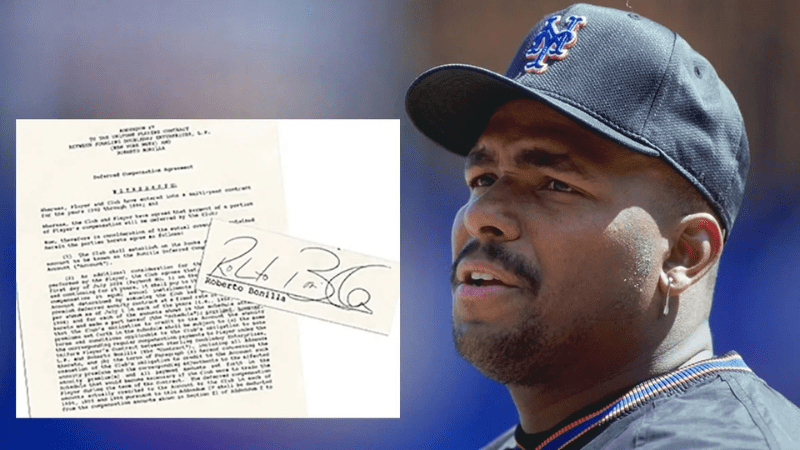

Every July 1st, Bobby Bonilla wakes up to one of the most consistent paychecks in sports: $1.19 million from the New York Mets.

He hasn’t played for the team in over two decades — yet they’re still cutting checks.

To some, it’s a running joke. To others, it’s the smartest contract in baseball history and a masterclass in how to turn a single moment of leverage into a lifetime of financial security.

But what happened? And what can founders, creatives, and investors learn from the most viral payday in pro sports?

How it happened

In 2000, the Mets owed Bonilla $5.9 million to buy out the remainder of his contract. Rather than taking the lump sum, Bonilla and his agent, Dennis Gilbert, proposed something unusual: defer the payment.

Instead of $5.9 million upfront, Bonilla would start receiving $1.19 million per year from 2011 to 2035 — a total of nearly $30 million over 25 years.

Why would the Mets agree?

At the time, ownership believed they could earn far more than $5.9 million by investing that money elsewhere, particularly in funds managed by Bernie Madoff, whose returns were (supposedly) 10–15% annually.

They were wrong. And Bonilla walked away with the win of a lifetime.

The deal behind the deal

This wasn’t luck. It was long-term thinking and savvy structuring.

Bonilla was already wealthy. He didn’t need the cash immediately. That gave him leverage and patience. Dennis Gilbert was a former insurance executive who understood compound interest, guaranteed income, and how to turn volatility into stability.

The Mets were overconfident. Betting on inflated returns with Madoff’s Ponzi scheme made Bonilla’s deferred deal look “cheap” at the time.

By 2035, Bonilla will have collected over five times the original buyout amount — all without touching a glove, signing an endorsement, or lifting a finger.

Why it was brilliant

Bonilla’s deal remains one of the most iconic in sports for a few reasons:

Predictable income – He turned a one-time payout into a 25-year annuity — a rare feat for athletes.

Tax efficiency – Spreading income over time likely reduced his tax burden compared to a lump sum.

Cultural relevance – “Bobby Bonilla Day” is now a viral annual moment, keeping his name in headlines long after his last game.

Risk transfer – He offloaded investment risk to the Mets, who lost big while he locked in guaranteed income.

And here’s the kicker: Bonilla also has a deferred deal with the Baltimore Orioles. He’s not alone either — Ken Griffey Jr. was the fourth-highest-paid Cincinnati Red in 2023, despite retiring in 2010.

The bigger lesson

Bonilla didn’t just negotiate a buyout — he negotiated a financial legacy. Most people focus on how much money they can make upfront. Bonilla focused on how to make it last — and how to structure it in his favor.

This story is a reminder that wealth isn’t just about the size of the check. It’s about the terms, the timing, and the long game.

Whether you’re a founder, athlete, or artist, it’s worth asking:

Are you thinking beyond the current check?

Can you use today’s leverage to build tomorrow’s freedom?

Could deferred revenue, royalties, or revenue shares create more upside than cash up front?

Legacy isn’t always built with big money. Sometimes, it’s built with smart money.

Bonilla’s contract isn’t the only example of long-term financial thinking in sports. Allen Iverson, another iconic figure, negotiated a $32 million trust fund from Reebok, set to be unlocked on his 55th birthday. His story is equally brilliant (and misunderstood).

The smartest players — on the field or off — don’t just chase the biggest checks. They chase the smartest terms.

If you’re building something today, ask yourself: Are you structuring your deal like a moment… or a movement?

Because July 1st isn’t just Bobby Bonilla Day. It’s a reminder of what happens when you let patience pay.