Africa is discarding renewable feedstocks that global markets urgently need, even as the African circular economy begins to gain momentum.

Europe continues to increase imports of waste-based inputs like used cooking oil to meet renewable fuel mandates, while millions of tons of African waste remain uncollected and unmonetized.

Nigeria alone generates huge volumes of used cooking oil and organic waste each year, most of which never enters a formal supply chain.

This gap between local surplus and global demand has created a clear arbitrage and one of Africa’s most overlooked industrial opportunities.

Global demand underscores the scale of this opportunity. The used cooking oil market alone was valued at $6.9 billion in 2024 and is projected to reach $13.3 billion by 2032, driven largely by renewable fuel mandates in Europe and the United States.

A Case Study: Logone Group

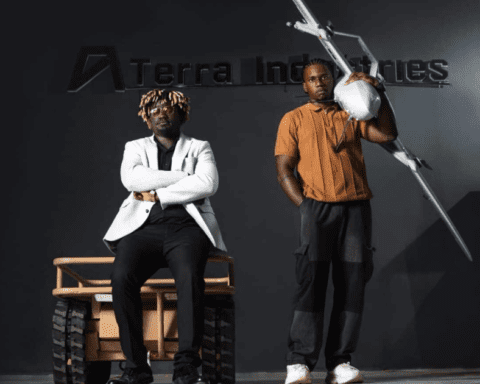

Founded in 2023, Logone Group is building a structured circular supply chain for used cooking oil and organic waste in Nigeria.

The company plans to source waste directly from restaurants, food vendors, SMEs, and agricultural processors, then process and certify it for export to renewable fuel markets.

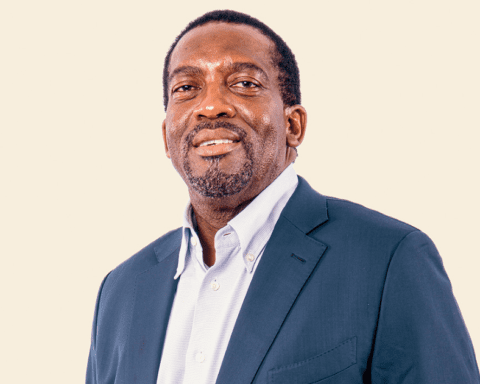

CEO Lanre Lawson explains, “Logone intends to directly engage SMEs in waste collection, giving them a consistent income source and integrating them into formal supply chains.”

Under its base-case plan, Logone expects to increase incomes for more than 200,000 SMEs and smallholders by 29 to 34 per cent each year, benefiting over a million people and preventing more than 1 million tons of CO2 emissions. SMEs incur no cost or operational risk within the model.

“With the right investment partners,” Lawson says, “we can scale from pilots to nationwide integration of SMEs and deliver far greater economic and environmental impact.”

Impact reporting is set to begin in 2026.

Why the African Circular Economy Is Growing

Global renewable fuel mandates are driving long-term demand for waste-based feedstocks. At the same time, Africa continues generating millions of tons of organic and agricultural waste that strains cities and creates environmental challenges.

This mismatch positions waste-to-value ventures as both climate solutions and export industries. Across the continent, companies in clean cookstoves, upcycled construction, and agri-processing are proving that circular solutions can scale quickly with the right capital. Kenya’s BURN Manufacturing is a leading example.

Capital Is Mobilizing

New financing vehicles are emerging to support Africa’s circular transition. The Africa Circular Economy Facility, managed by the African Development Bank, provides grants and concessional capital to early-stage ventures.

Private climate funds and blended finance platforms are de-risking projects for commercial investors.

Davinah Milenge Uwella of the African Development Bank notes, “Behind every circular start-up is an entrepreneur rethinking how Africa creates value. Through ACEF, we provide the early support needed to attract investors and scale the transition.”

Catalytic investors such as FSD Africa Investments, Allied Climate Partners, and blended finance mechanisms like the Catalytic Climate Finance Facility are directing capital toward scalable circular models.

This financing ecosystem is essential to scaling the African circular economy and helping ventures formalize waste streams at national and regional levels.

The Road Ahead

Africa’s green industrialization is emerging through companies like Logone Group that are formalizing waste streams, increasing incomes, and supplying global renewable markets. The African circular economy offers a path to build local industry while meeting global climate demands.

The next wave of growth will come from ventures building circular value chains, local processing capacity, and climate-aligned industries.

For investors, this is a rare early entry point into a new industrial base taking shape across the continent.

By turning waste into economic opportunity, ventures like Logone are demonstrating how the African circular economy can generate income, reduce emissions, and create export-ready value at scale.

Join our Investor Network to receive curated insights and updates on capital-raising opportunities.