By any institutional standard, investing demands discipline, sequencing, and patience.

Determining when conviction has been earned and when capital should move requires structure, repetition, and time.

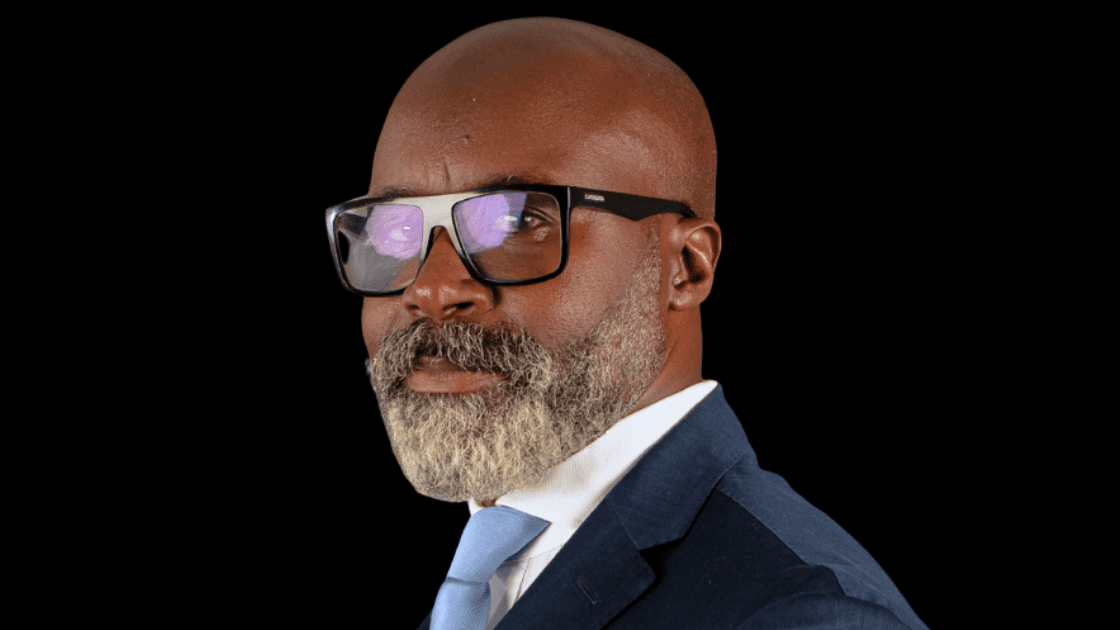

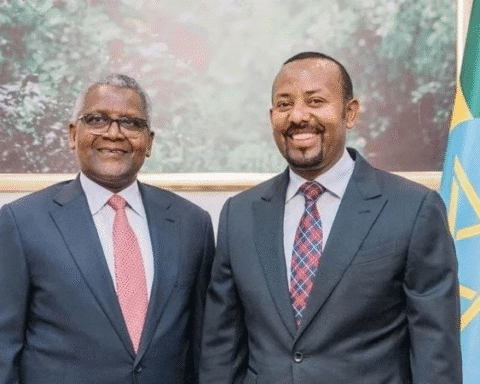

For Ibrahim Sagna, Executive Chairman of Silverbacks Holdings, capital allocation follows a deliberate progression. Across three decades in global finance and emerging markets investing, he has developed a framework for narrowing broad exposure into durable ownership.

That approach has shaped Silverbacks into an alternative investment platform managing over $100 million in assets, backing high-growth companies operating from Africa and scaling globally.

The firm maintains exposure across technology, sports, entertainment, and the creative economy, with an orientation defined by process and execution.

Evaluating Opportunity: The Signals That Matter First

When assessing a new opportunity, Sagna focuses on repeatable signals that correlate with long-term durability.

Silverbacks applies five criteria consistently.

The first is the presence of second-act founders, spin-offs, or serial entrepreneurs. Teams with prior experience tend to recognize inflection points earlier and operate with greater clarity under pressure.

The second criterion is the customer experience. Silverbacks looks for platforms that deliver what Sagna describes as a jaw-dropping experience, evident through usage patterns, repeat engagement, and accelerated recurrence.

Third, growth must be sustained and measurable. Companies are expected to demonstrate year-over-year growth above sixty percent across a trailing three-year period.

Fourth, over a third of revenues must be invoiced in hard currency. Exposure to dollars, euros, pounds, or yen signals export orientation and structural resilience.

Finally, while a company’s origin may be the African continent, its operating ambition must extend globally. Market scope and execution are expected to match that ambition.

These filters operate as thresholds. Opportunities that meet them advance through the investment process.

From Possibility to Inevitability: How Conviction Is Built

Silverbacks’ investment model progresses along a conviction axis that moves through three stages.

At the first stage, the firm invests in fund managers, creating broad exposure across sectors and geographies. This stage captures possibility.

The second stage involves co-investments structured through special purpose vehicles alongside managers Silverbacks already backs. These opportunities represent probability as performance data accumulates and alignment strengthens.

The final stage emerges when companies continue to outperform, expand globally, and compound faster than peers. At this point, Silverbacks may increase ownership or acquire positions outright from managers and in secondary markets. These businesses reach what Sagna describes as inevitability.

This progression has produced realized outcomes. Since its inception, Silverbacks has completed 10 profitable exits for its investors, averaging 8x cash on cash – all while continuously building up positions in its favorite companies, reinforcing its emphasis on staged conviction and durability over time.

Risk as a Discipline

Risk management sits at the center of Silverbacks’ operating culture. Sagna describes the firm as a risk manager with a long-term orientation toward capital appreciation.

He distinguishes between early-stage capital deployment and later-stage ownership using a practical metaphor. Early-stage capital accepts wider uncertainty. Silverbacks positions itself to engage as structures, teams, and systems demonstrate durability.

This approach informs portfolio construction, timing, and concentration. Capital is deployed in stages, and exposure increases as uncertainty compresses.

The objective remains consistency across cycles.

Founders, Fundamentals, and Compounding

Across sectors, Sagna has observed two variables that shape long-term outcomes: leadership quality and business fundamentals.

Equity investments emphasize founders and management teams.

Experience, cohesion, and adaptability determine execution under pressure. Second-act teams accelerate decision-making and reduce avoidable friction.

Structures closer to debt elevate fundamentals. Industry dynamics, cash flow predictability, and downside protection become central.

Opportunities where experienced founders operate within strong fundamentals tend to compound more effectively over time and invite a great capital mix.

Brand, Identity, and Enduring Value

Beyond operational metrics, Sagna pays close attention to how customers relate to products and platforms.

He describes a progression that mirrors human relationships. Platforms begin as likeable, attracting users through features and performance.

Over time, they become lovable as users accept imperfections in exchange for value. The final stage occurs when identity becomes involved, and customers self-identify with the brand.

At that point, durability strengthens.

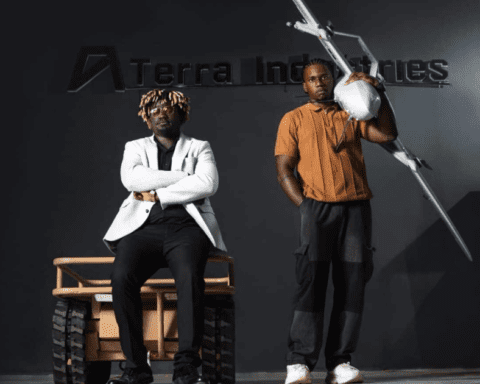

This perspective explains Silverbacks’ investment in media and narrative infrastructure alongside capital.

Platforms such as the firm’s IN THE VALLEY podcast, which commands over 34 million views across social media and is also available onboard on Qatar Airways, function as amplifiers for founders, ecosystems, and operating stories. Visibility builds familiarity.

Familiarity supports trust. Trust accelerates adoption and permanent loyalty.

Portfolio Construction and Global Scale

Silverbacks’ capital allocation reflects this long-term orientation.

Over 40% of the firm’s entire portfolio is allocated to Moove, an African-born fintech mobility platform backed by Uber, expanding Waymo robotaxis in Phoenix, Miami, and London, as well as operating over 39,000 vehicles in 29 cities across 5 continents.

Position sizing of this scale reflects sustained conviction developed over time, supported by execution across geographies and consistent performance.

Looking Ahead: Technology, Diaspora, and Relevance

Sagna sees the next decade shaped by technology-enabled proximity.

Global diasporas now share information, experience, and influence at unprecedented scale.

Technology allows individuals once considered peripheral to reach global audiences quickly and reshape perception through participation.

Cultural relevance, narrative clarity, and execution increasingly interact with capital formation.

Silverbacks continues to focus on identifying dominant platforms early, supporting founders through structured growth, and building businesses designed to endure beyond their markets of origin.