Kenya-based venture capital firm Chui Ventures announced the successful final close of its inaugural fund, Fund I, at $17.3 million, significantly surpassing its initial target of $10 million.

The oversubscribed fund will focus on providing crucial seed-stage capital to tech-enabled, mass-market businesses across Sub-Saharan Africa.

The fund’s close signals growing global confidence in African technology and the firm’s gender-inclusive investment strategy.

The capital was secured from a diverse group of investors, including key institutional backers such as the Mastercard Foundation Africa Growth Fund and the Michael & Susan Dell Foundation.

Local Capital Mobilized

A notable feature of the fund’s raise was the successful mobilization of local capital. Over 30 African High-Net-Worth Individuals (HNWIs) participated, with more than 60% being African female executives.

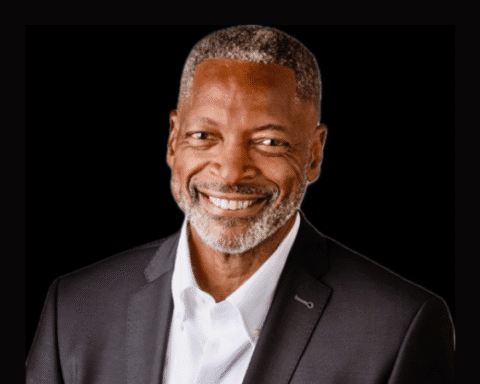

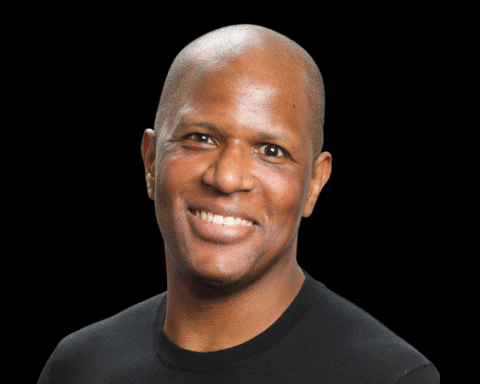

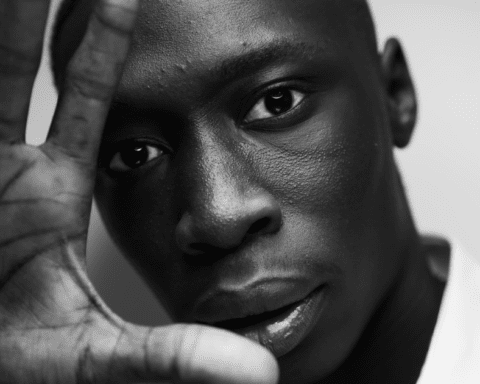

“This successful raise is a testament to the immense potential of African entrepreneurs and the ability of local GPs to attract both global and local capital,” said Joyce-Ann Wainaina, General Partner at Chui Ventures.

Diverse Portfolio and Future Plans

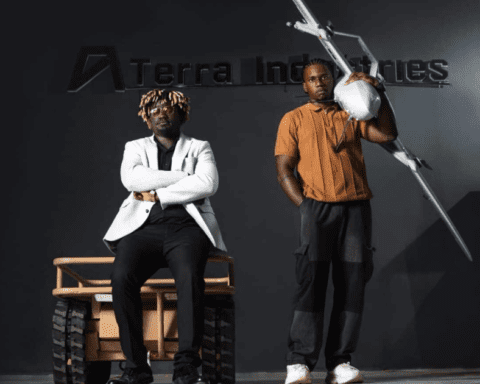

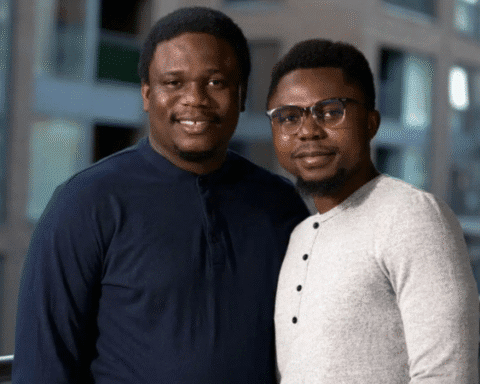

Chui Ventures has already deployed 60% of Fund I across 18 startups in sectors including fintech, healthtech, agritech, and logistics.

A core tenet of the fund is its commitment to gender diversity, with 44% of its portfolio companies featuring female founding teams.

Current portfolio companies include Nigerian online grocery platform Pricepally, Kenya-based supply chain SaaS company Leta, and skincare brand Uncover.

These companies are credited with creating over 1,200 direct jobs and more than 40,000 indirect jobs.

Following the close of Fund I, Chui Ventures is already planning for its next phase of growth. The firm intends to launch Fund II with a target size of $60 million and a hard cap of $100 million.

Fund II will expand the firm’s reach to include North Africa and deepen its focus on financial services, B2B software, digital commerce, and climate technology.

Interested in investing in Black founders and fund managers? Join our Investor Network to get curated updates on capital-raising opportunities.