Kwely is a B2B wholesale distribution platform dedicated to harnessing Africa’s extensive trade possibilities, driven by the recognition of a substantial untapped export market valued at $250 billion.

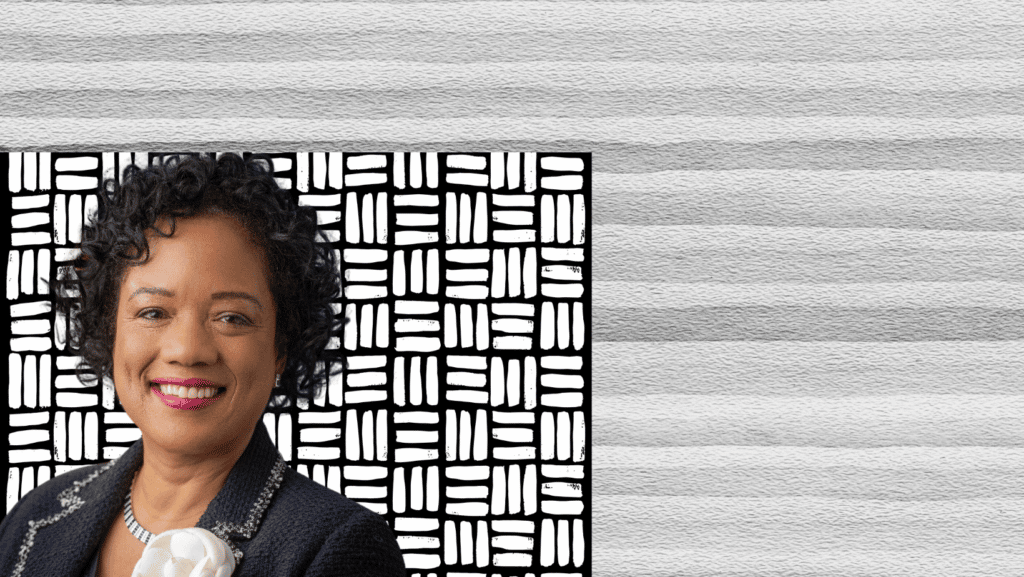

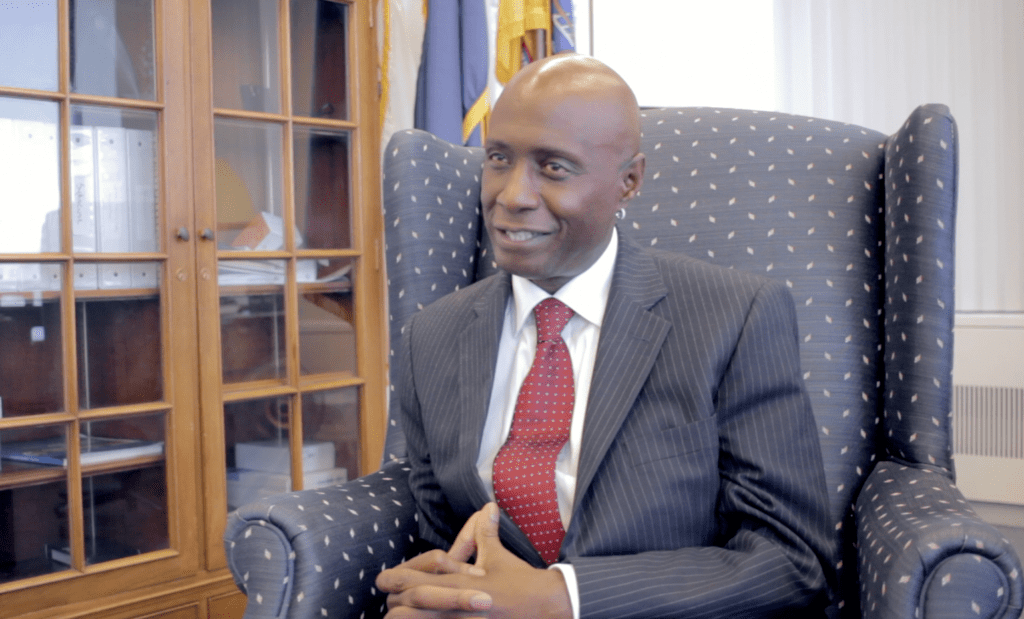

In this interview, Kwely founder and CEO Birame Sock discusses the platform’s beginnings, fueled by the ambition to transform global markets for African suppliers.

What inspired you to start Kwely?

The inspiration behind founding Kwely stemmed from recognizing the substantial challenges faced by African suppliers in accessing international markets.

Witnessing the untapped export potential of $250 billion from Sub-Saharan countries, particularly with 72% being exported outside the continent, prompted a determination to overcome existing obstacles hindering Africa from tapping into this vast market.

The vision emerged from a desire to revolutionize the global trade landscape for African products, addressing issues like poor marketing, branding strategies, and low-volume manufacturing processes. The goal was to create a transformative B2B e-commerce platform, ultimately establishing Kwely as a pivotal player in connecting African suppliers with international buyers.

Are there shifts in consumer behavior or emerging markets that could impact the sourcing of African products?

Yes, several shifts in consumer behavior and emerging market trends could significantly impact the sourcing of African products. Firstly, the global trend towards conscious consumerism and sustainability has led to an increased demand for ethically sourced and environmentally friendly products. African goods, often rooted in natural and sustainable practices, are well-positioned to meet this growing demand.

Additionally, the rise of e-commerce and the increasing preference for online shopping provide an opportunity for African products to reach a broader international audience. With Kwely operating as a B2B e-commerce platform, it aligns with the shift towards digital sourcing and facilitates the streamlined procurement of African goods.

Moreover, the diversification of product offerings, particularly in the health and wellness sector, aligns with the growing interest in natural and traditional remedies. African products like Moringa, Hibiscus, or Baobab-based items, as emphasized by Kwely, tap into this emerging market trend.

Overall, the evolving landscape of consumer preferences and the rise of online markets present favorable conditions for the sourcing of African products, positioning Kwely strategically in the global trade landscape.

What are the primary obstacles faced by African manufacturers in entering global markets, and how does Kwely help them overcome these hurdles to meet international standards?

African manufacturers face several obstacles when entering global markets, and Kwely plays a crucial role in helping them overcome these challenges to meet international standards. Some primary obstacles include:

Limited Market Access: Many African manufacturers struggle with limited access to global markets due to poor infrastructure, trade barriers, and a lack of visibility. Kwely addresses this by developing a wide distribution network through various channels including a B2B e-commerce platform that serves as a marketplace, providing a streamlined channel for international buyers to discover and purchase African products.

Inadequate Branding and Marketing: Local suppliers often lack effective branding and marketing strategies, making it challenging to compete on a global scale. Kwely’s TEKKI Challenge addresses this issue by incubating and elevating local brands for global export. The initiative ensures that products meet international standards and FDA requirements, enhancing their marketability.

Low-Volume Manufacturing Processes: Many African manufacturers operate on a smaller scale, leading to challenges in meeting the demand of international markets. Kwely tackles this obstacle by supporting local suppliers through the syndication of multiple suppliers that all follow the same production standards and partnerships with financing programs to help support suppliers to scale up their production capacity. This contributes to overcoming the hurdle of low-volume manufacturing.

Poor Financing Options: Access to financing is a common challenge for African manufacturers. Kwely recognizes the importance of resolving this issue to scale up production. The company focuses not only on technology but also on acting as the gateway between customers and suppliers thereby pre-financing certain expenses on behalf of the suppliers such as branding development and packaging purchasing. In creating higher demand, suppliers can qualify for certain loans that would allow them to fulfill the orders.

Packaging and Quality Assurance: Meeting international packaging standards and ensuring product quality are critical for global acceptance. Kwely provides in-house packaging services, supporting local suppliers in designing export-ready packaging that adheres to global quality standards. Additionally, the company implements rigorous quality assurance processes to guarantee that products listed on its platform are export-ready through a co-packing facility which allows Kwely to ensure that the packing process meets the standards.

By addressing these obstacles, Kwely acts as a catalyst for African manufacturers, enabling them to navigate the complexities of global markets and meet international standards more effectively.

What are your primary goals or aspirations for Kwely in the next few years?

Our primary goals and aspirations for Kwely in the next few years include:

Global Distribution Leadership: Establishing Kwely as a leading global distributor of African products, emphasizing its role as a primary connector between African suppliers and international buyers.

Market Expansion: Focusing on expanding the market presence of African products beyond the continent, particularly targeting the U.S. market. This involves strategic partnerships, engagement with major U.S. retailers, and listing products on platforms like Amazon.

Brand Incubation Success: Ensuring the success of the TEKKI Challenge and brand incubation program, elevating the quality and recognition of made-in-Africa products. The goal is to empower local suppliers, fostering their growth from small enterprises to significant players in the African industrial sector.

Economic Impact: Contributing to job creation and the development of a comprehensive ecosystem, spanning agricultural initiatives, industrial production facilities, and branding and marketing services. The aim is to have a positive economic impact on local communities.

Financial Growth: Securing additional funds through ongoing fundraising efforts to support Kwely’s expansion plans and facilitate its transition into the U.S. market. This includes projections of substantial revenue growth, with a forecast exceeding $2 million by December 2024.

Sustainability and Quality: Maintaining a commitment to sustainability and quality assurance in every stage of the export process. This involves ensuring that products meet international standards and providing a holistic solution for both suppliers and buyers.

What advice would you give to other B2B marketplace founders?

My advice for other B2B marketplace founders:

- Understanding the Market Dynamics: For B2B marketplaces in developing countries, delve beyond technology and comprehend the gaps between buyers and suppliers. Construct your marketplace as a bridge, addressing concerns from both sides that hindered their initial business interactions.

- Phased Marketplace Development: Build your marketplace incrementally. Identify low-hanging fruit in terms of products, brands, and categories. Cast a wide net to identify your first customers and refine your platform based on real-world feedback.

- Data-Driven Decision-Making: Embrace a data-centric approach. Implement the 80-20 rule, recognizing that a minority of your products will likely contribute to the majority of your revenue. Focus marketing efforts on high-performing products and adapt to changing market dynamics. Understand that the set of high-performing products may evolve over time or with seasons. Stay agile and adapt your strategies based on real-time insights to ensure sustained marketplace success.

- MANAGE YOUR INVENTORY! Only buy what you need based on short term forecasts until you have a strong handle on your customer demand.