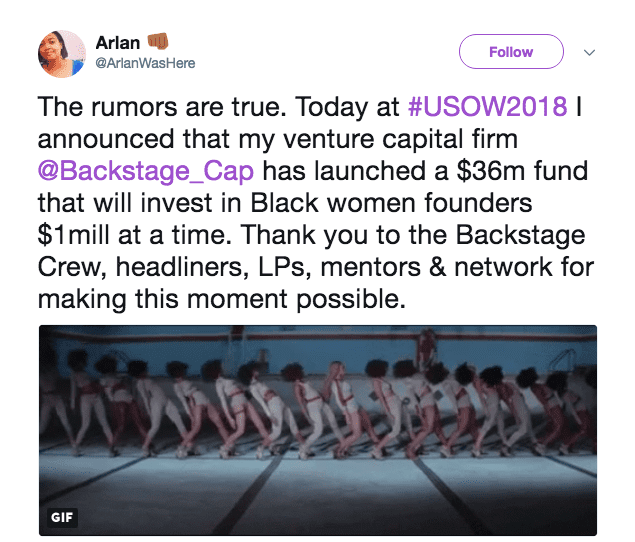

Recent reports have found that less than 1% of venture capital is invested in Black businesses in the US and the number for the UK is no better.

London based, Impact X Capital Partners is a Black owned venture capital firm that is raising £100 Million ($131 million) to support underrepresented entrepreneurs within the entertainment, media, tech, health, and digital industries.

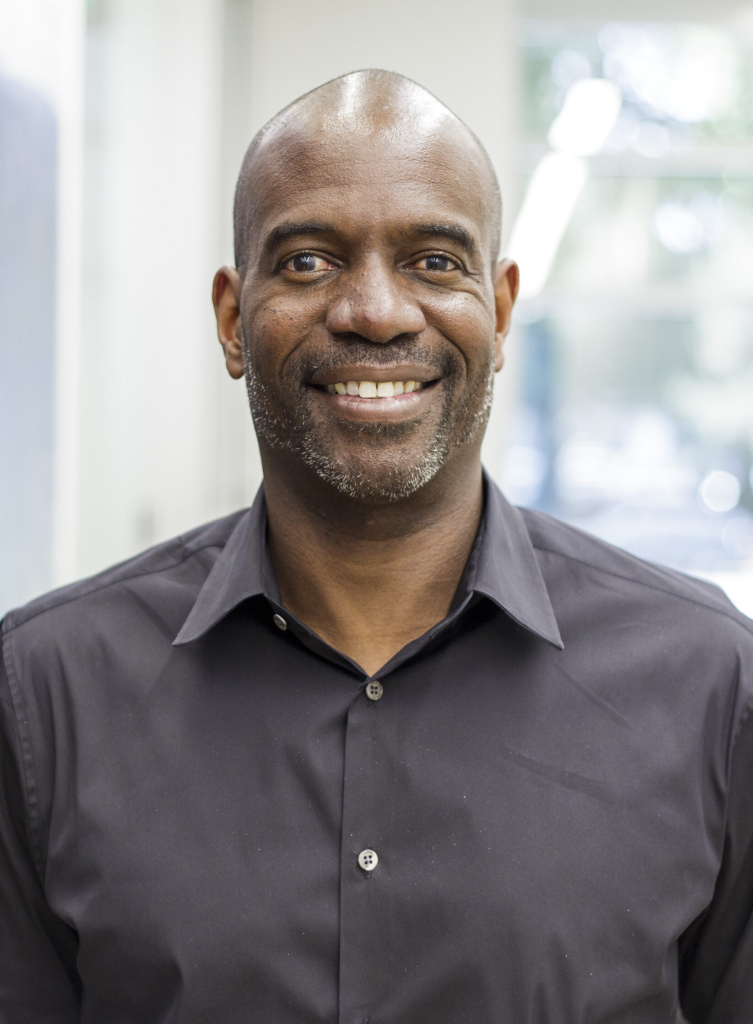

We spoke with Ezechi Britton. Founding Member, Principal & CTO in Residence at Impact X Capital about several topics including:

- The need for diversity in the tech industry

- The importance of investing in Black founders

- How entrepreneurs can position themselves to be attractive to investors

Don’t forget to LIKE the video and SUBSCRIBE to the channel!

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram & Twitter

Get your SHOPPE BLACK Apparel!