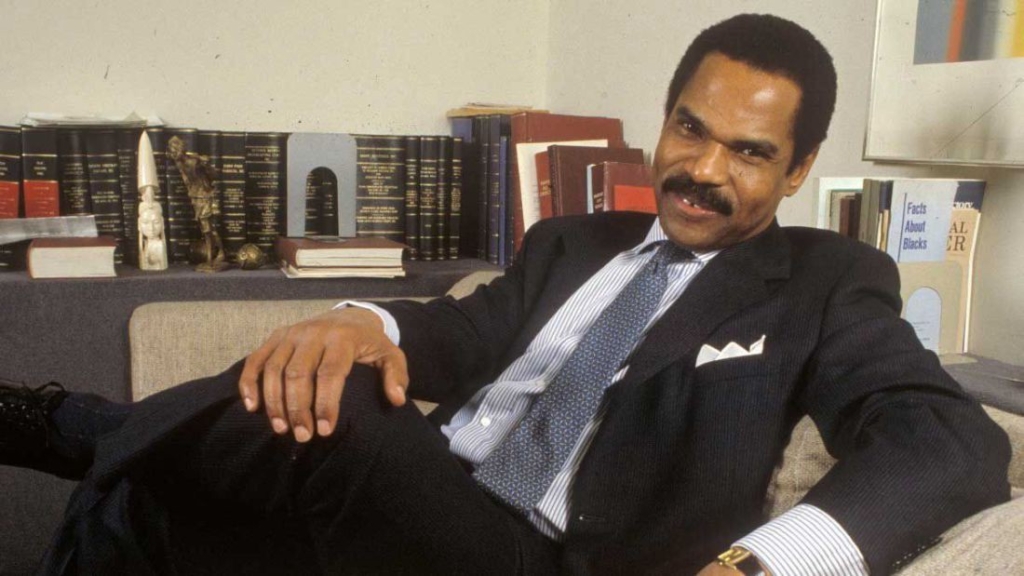

Dmitri Dawkins is a Jamaica based entrepreneur and investor. He serves as managing director at Graft Ventures, a venture capital firm focused on scaling Caribbean-based businesses.

In this interview, we discuss the investment climate in Jamaica and what effects the pandemic has had on opportunities there.

We also discuss some misconceptions about the Jamaican economy as well as the unique advantages and challenges that the Caribbean region has compared to US or European markets.

Don’t forget to LIKE the video and SUBSCRIBE to our channel!

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram &Twitter