Over the past seven years, Shoppe Black has grown from an idea into a global community of almost 400,000 people. The members of this digital community may have varying views on a number of topics, but we have at least one thing in common, an interest in seeing Black people win.

As a company, it’s important that we find new, innovative, and most importantly, safe ways for us all to connect and engage with one another.

So, in an effort to enhance our digital community, we’ve installed Yappa, an audio and video commenting tool created by the good folks at Yappa World Incorporated.

About Yappa

Yappa is a Black owned audio and video commenting tool used to maximize a website’s content and audience participation. The company was founded by Kiaran Sim and Jennifer Dyer.

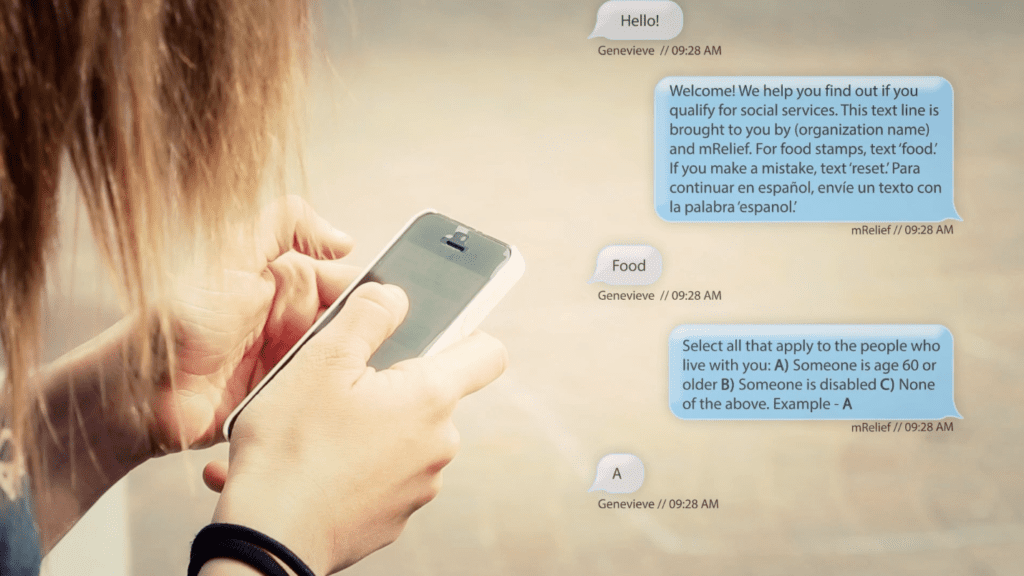

In a recent conversation with Kiaran, he shed some light on what inspired the creation of Yappa. “We identified a problem with how we communicated as a society and the digital platforms that fostered an environment that can bring out the worst in humanity.

Cyber-bullying, keyboard bashing, trolling, and unfiltered rhetoric have become a part of everyday life on social media. We can often be misunderstood or misrepresented via 150 text characters. We created Yappa to offer a tool for communication that fosters productive, meaningful engagements.”

According to Kiaran, the response since they launched has been overwhelmingly positive. In 2020, Yappa enjoyed its most successful year to date. Collaborations with iHeart Media, Shaquille O’Neal, Daymond John and others have given Yappa exposure to new audiences.

“Across the summer of 2020, we got together with Big Boy’s Neighborhood (Real 92.3FM), to create a town hall for Los Angelino’s to share their stories on how the pandemic has impacted their lives. We received an overwhelming response, which truly brought a sense of product validation”, said Kiaran.

Future Plans

When asked about future plans for the company, Kiaran said that while he could certainly come up with some ideal scenarios, he would rather live in the moment and focus on the immediate goals as an entrepreneur.

“This way, instead of filling my thoughts with lofty visions of grander, I take a more agile approach, following the breadcrumb trail that our audience leads us to. Maybe we’ve been acquired, we do an IPO, or we achieve another measurement of success, but I only see great things in store for Yappa’s future at the current rate of scale.”

Advice for aspiring entrepreneurs

“The one word of advice I would give to an aspiring entrepreneur is don’t be afraid to find out who you are. Fear of failure is the biggest obstacle you will have to overcome regularly. Don’t be scared to fail, but in the same breath, do everything you can to validate your business ideas first before making significant life-changing decisions.”

GET STARTED!

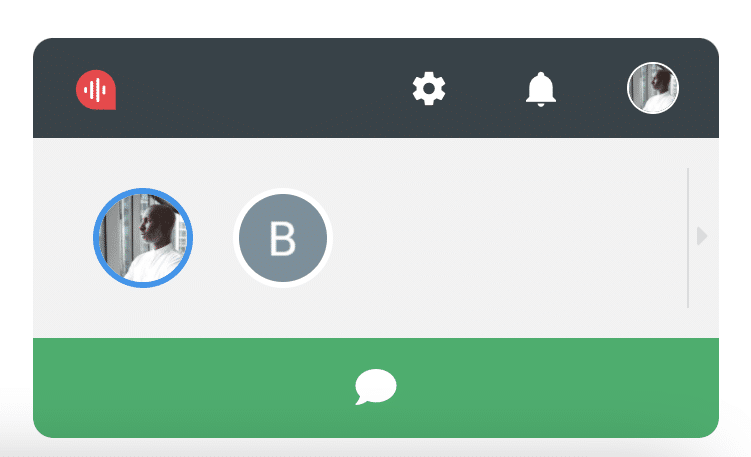

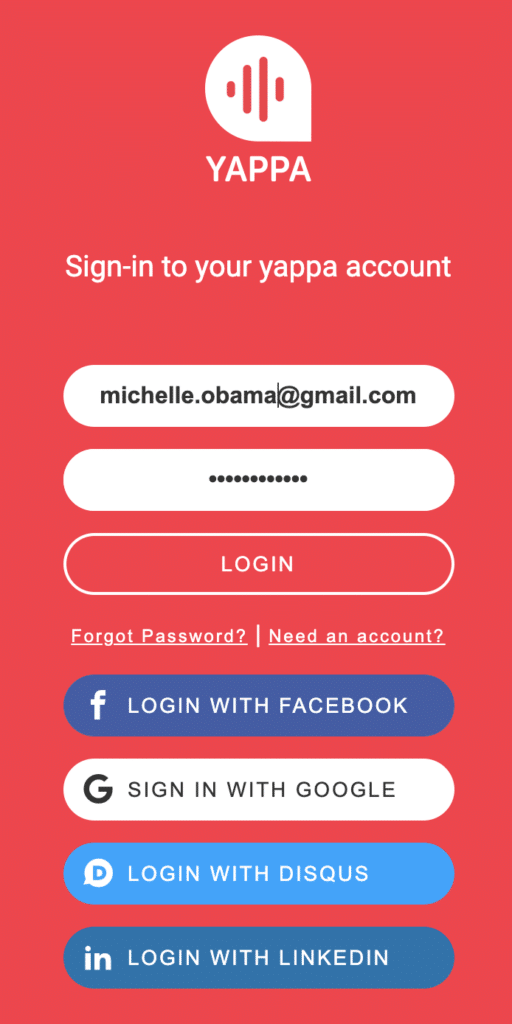

Step 1: Scroll down to the bottom of the article until you see this “Sign Up/Login” box.

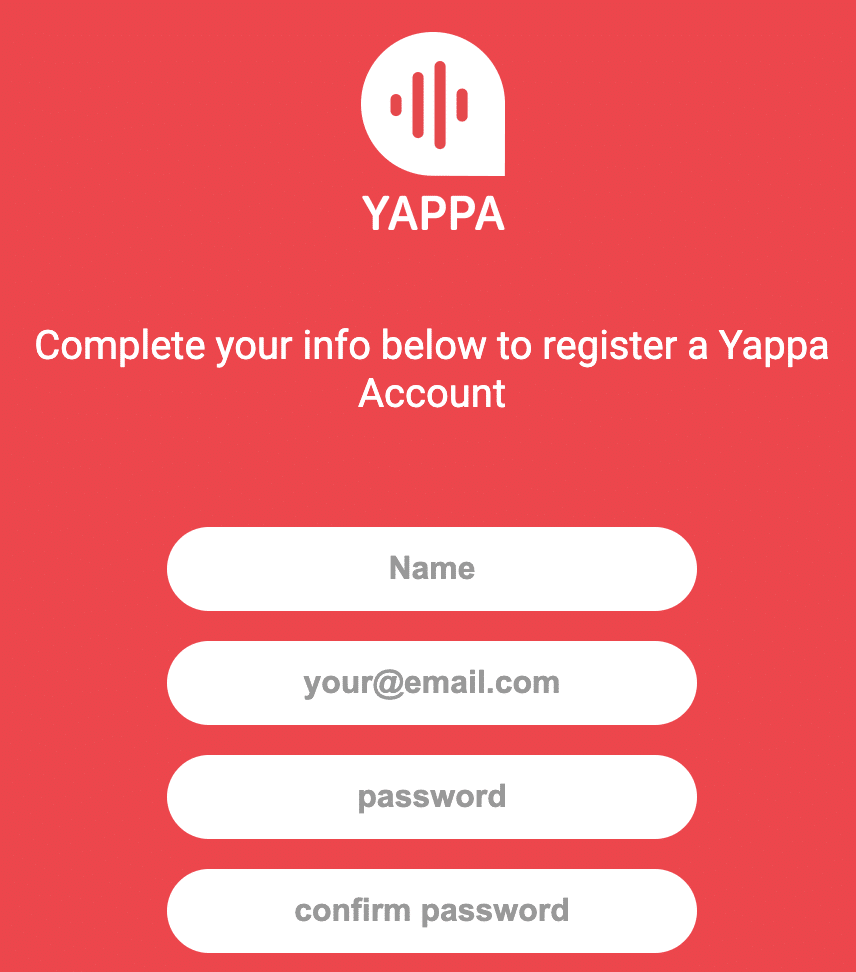

Step 2: Create an account

Step 3: Log in

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram & Twitter

Get your SHOPPE BLACK Apparel!