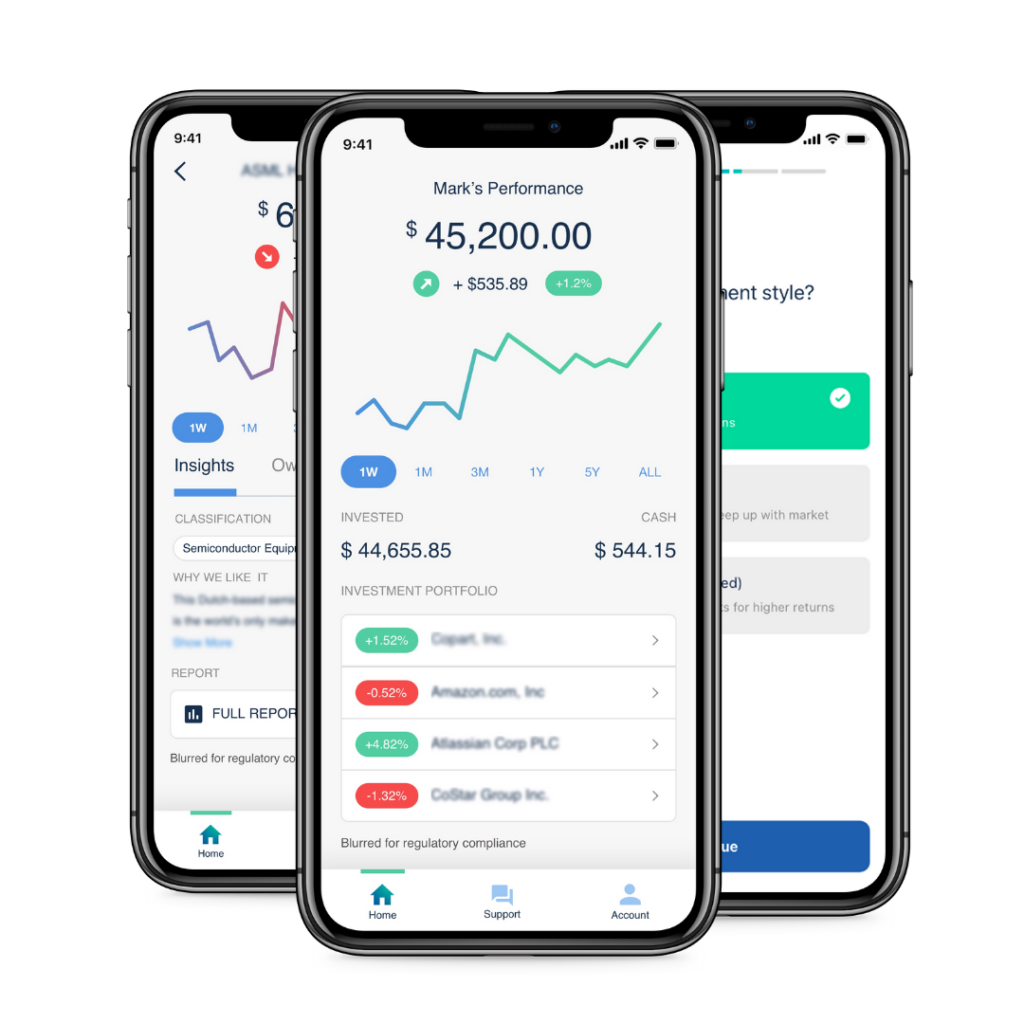

When you’re a beginner in the stock market, it can feel intimidating to research and choose stocks and other investments on your own.

Xantos Labs is an SEC-registered investment adviser that builds and manages investment portfolios for everyday folks.

Their goal is to offer a low minimum, low fee, and a premium investing experience to people that don’t have millions in the bank.

The investment advisor recently announced that it is now available on a global scale. Anyone in 150+ countries including the UK, India, and Nigeria can open an account and invest.

This is a significant milestone for the fintech startup and aligns with its mission to lower access barriers and empower millions in the rising global middle class with a modern investment advisory solution to build wealth.

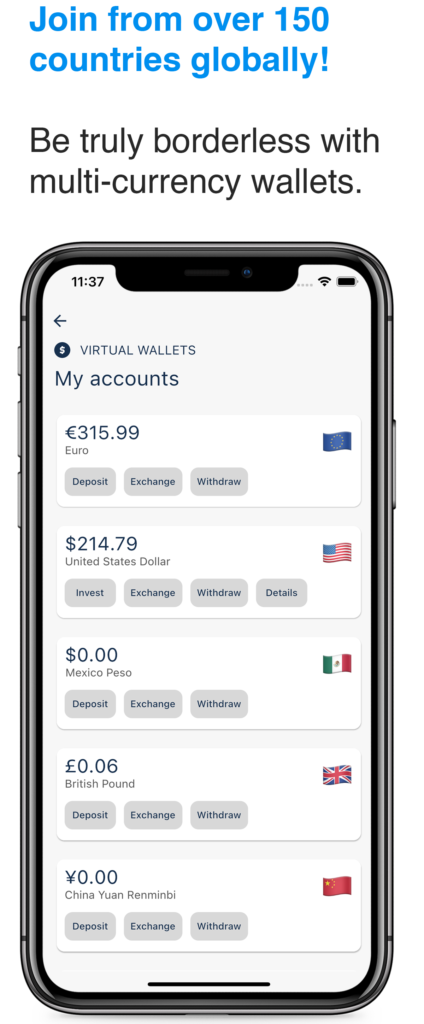

Users outside the United States can fund their accounts using USD wire transfers. Additionally, depending on the region, they offer virtual multi-currency wallets; enabling users to seamlessly:

- Add and hold multiple currencies in their account, from GBP to USD to EUR

- Exchange funds at a competitive, near interbank rate – the rate at which banks exchange money with each other

- Move funds across borders through an account under their name

Xantos Labs supports 30 major currencies today including USD, GBP, EUR, CNY, MXN, and JPY.

“We looked at our competitors and realized that we could exercise a first market mover advantage if we were willing to jump into international markets. As we were evaluating different partners that could help us make this happen, Currencycloud stuck out as a particularly capable platform. We knew we could work together on delivering extremely high-quality investment advisory services to the world,” said Chuk Orakwue, Managing Partner at Xantos Labs.

In the interview below, Chuk shares:

- What investment strategy they use and why they chose it.

- How Xantos Labs differs from other investment and trading apps.

- How they provide the average investor with more solutions than Wall Street.

- How his company has achieved better returns than the market.

The app is available now in the Apple Store and on Google Play.

Don’t forget to LIKE the video and SUBSCRIBE to our YouTube channel!

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram & Twitter