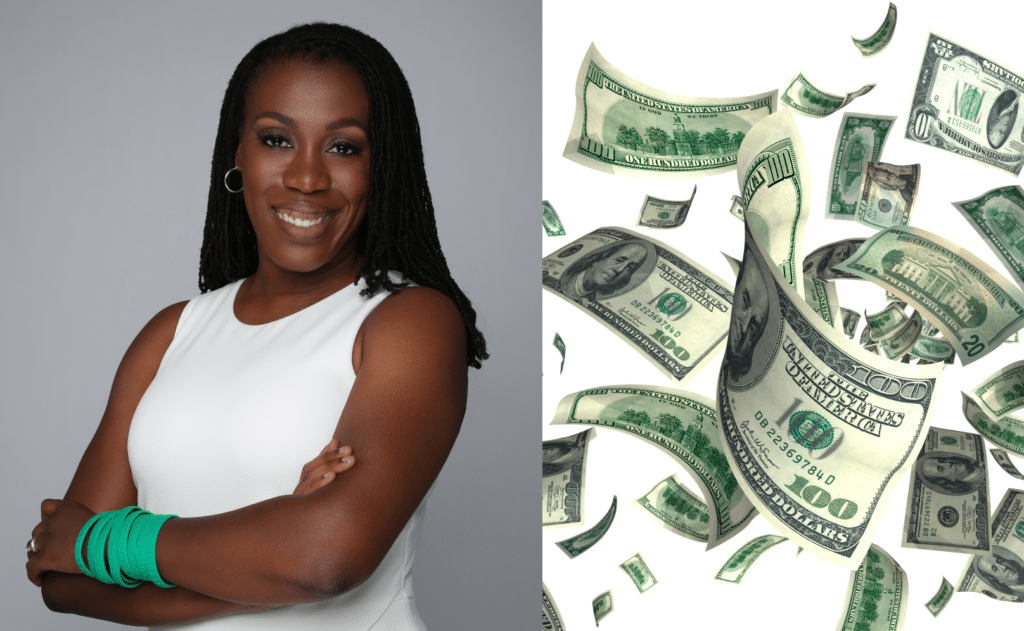

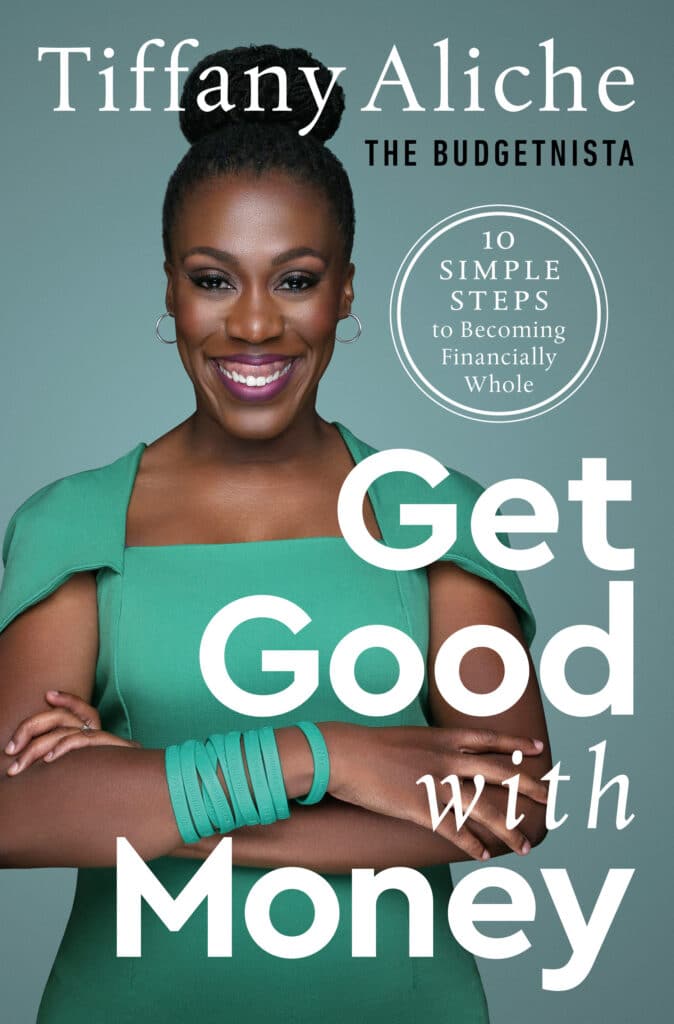

Tiffany “The Budgetnista” Aliche is an award-winning teacher of financial education and is quickly becoming America’s favorite, personal financial educator.

In this interview, we discuss what business skills have helped her build multiple multi-million dollar businesses. We also discuss her new book, “Get Good with Money”, and what it means to be “financially whole.” Tiffany also shared the first five steps to achieving financial wholeness.

Don’t forget to LIKE the video and SUBSCRIBE to our channel!

Subscribe and Follow SHOPPE BLACK on Facebook, Instagram &Twitter

Get your SHOPPE BLACK Tees and Hoodies!