Congressional leaders reached an agreement with the White House on Tuesday for the relief bill to aid small-business owners. The bill, which includes a $310 billion refresh of the Paycheck Protection Program, has now been sent to the House for approval.

Here are answers to some of the most common questions about the future of the PPP program and alternative financing.

What’s happening with the Paycheck Protection Program?

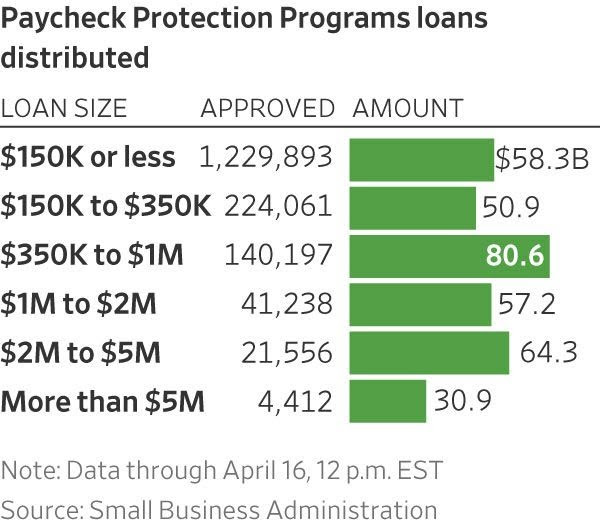

The initial $350 billion for the PPP was designed to help small businesses cover payroll and other costs during the coronavirus pandemic. The program was exhausted as of April 16.

Lawmakers are now seeking to approve $484 billion to be allocated to small businesses, including $310 billion for the PPP program. House approval is expected Thursday.

I was approved for a PPP loan. Will I still get funding? How long will it take?

If you were approved and received confirmation from your lender, you can expect to receive PPP funds in around seven to 10 days. If you think you were approved, but didn’t receive any form of confirmation from your lender, it’s likely that you won’t receive a loan from the first $350 billion Congress put aside for this program.

Many bank clients believe they’ve been approved, but weren’t. The best way for a business owner to check whether or not they’ve been approved is to follow up directly with their lender. Many lenders have been proactive in updating their clients, and are planning to submit applications that weren’t approved by the SBA before the funding initially ran out.

How can I apply for the new round of PPP funds?

According to the SBA, lender enrollment and new loan applications aren’t being accepted at this time. Once the new bill is signed into law, the SBA is expected to announce when it will take applications for PPP again.

While waiting for PPP funding to resume, businesses should collect all required documentation for the program and send it to their bank lender. This enables the bank to prepare for submitting a client’s application as soon as the program opens again.

Tony Wilkinson, president and CEO of the National Association of Government Guaranteed Lenders, said that he expects funding to once again be gone in as quickly as a week.

“Lenders will be hitting the submit button on a significant number of applications as soon as it’s open,” he said.

If I applied to the first round of PPP, do I have to apply again?

Business owners don’t have to apply again if their application didn’t get approved in the first round. Many lenders have held on to these applications, and are prioritizing them in the pipeline for when the program opens up again.

How are lenders handling loans that didn’t get funded before the money ran out for the PPP?

Many lenders are continuing to process loans that didn’t get funded in the first round. They expect the process to move quickly when funds are available again.

Umpqua Bank, for example, has spent the past several days making sure small businesses have documentation and that their applications are completed and ready to go. The bank has had its teams working in shifts around the clock to get the high volume of applications completed.

“Our goal is to have as many small-business applications ready to submit to the SBA as soon as it reopens the PPP application process,” said Tory Nixon, senior executive vice president and chief banking officer at Umpqua Bank.

While it isn’t too late for business owners who haven’t yet applied, there is incredibly high demand. Reach out to your lenders as soon as possible to inquire whether they have the capacity to process your application.

“With the next round, it’s really a race against the clock to help as many small businesses as possible before the funding is again fully committed, which could happen within just a few days,” said Mr. Nixon.

The small-business loan program designed to keep workers employed is out of money, and some main street business owners hit by the coronavirus pandemic say that it simply isn’t enough to keep their business alive in the first place.

What can I use my PPP loan for?

PPP loans are primarily to be used for payroll-related expenses. At least 75% of the loan is required to be used for payroll; it is anticipated that no more than 25% can be used for mortgage interest, rent or lease payments, utilities and interest or debt accumulated since Feb. 15.

Utility expenses encompass necessities like cable and internet. Exceptions include personal expenses, including compensation above $100,000.

PPP funds must be used in 8 weeks to be forgiven. If unused or used for anything other than payroll or utility expenses, the loans aren’t forgivable and must be repaid, according to the Treasury’s fact sheet, which can be found online. Business owners will also owe money if they fail to maintain employee head-count.

Can I pay myself with the funds?

It depends on how the business is structured. If the business owner is a sole proprietor or salaried, they are entitled to pay themselves from the PPP. But if the business is an S corporation and the owner receives owner draws, then they aren’t entitled to use the money for their own pay.

For those who are eligible, the PPP can cover one’s salary up to $100,000.

Can I still get a traditional SBA loan?

For now, business owners can still apply for standard SBA loans, though a bank’s capacity to process them might be limited at this time. Call your bank first to ask if it can still be done in a timely manner.

While the money is available, standard SBA loans are a viable option for those who don’t qualify for the PPP, or are awaiting possible funding from it.

In addition, the SBA Debt Relief program is automatically suspending payments for all current and new borrowers for a six-month period. This includes principal, interest and fees for 7(a), 504 and microloans issued before this Sept. 27.

What about the Employee Retention Credit?

The Employee Retention Credit, which launched March 31, is a refundable tax credit implemented to help businesses to keep their employees on payroll.

Separate from the stimulus package, the tax credit is for 50% of up to $10,000 in wages for each employee if a business has been hurt by Covid-19, according to the IRS.

To qualify, a business must be fully or partially suspended due to the government order, or making less than 50% of comparable quarterly earnings.

Can I sign up for the Employee Retention Credit in addition to the PPP?

The Employee Retention Credit can’t be used in tandem with the PPP.

What resources are available for independent contractors or gig-economy workers?

Independent contractors and gig workers can collect unemployment. Businesses are encouraged to inform their contractors of this new benefit.

Independent contractors, sole proprietors and people who are self-employed are also qualified to apply for the PPP, according to the SBA.

Source: The Wall Street Journal