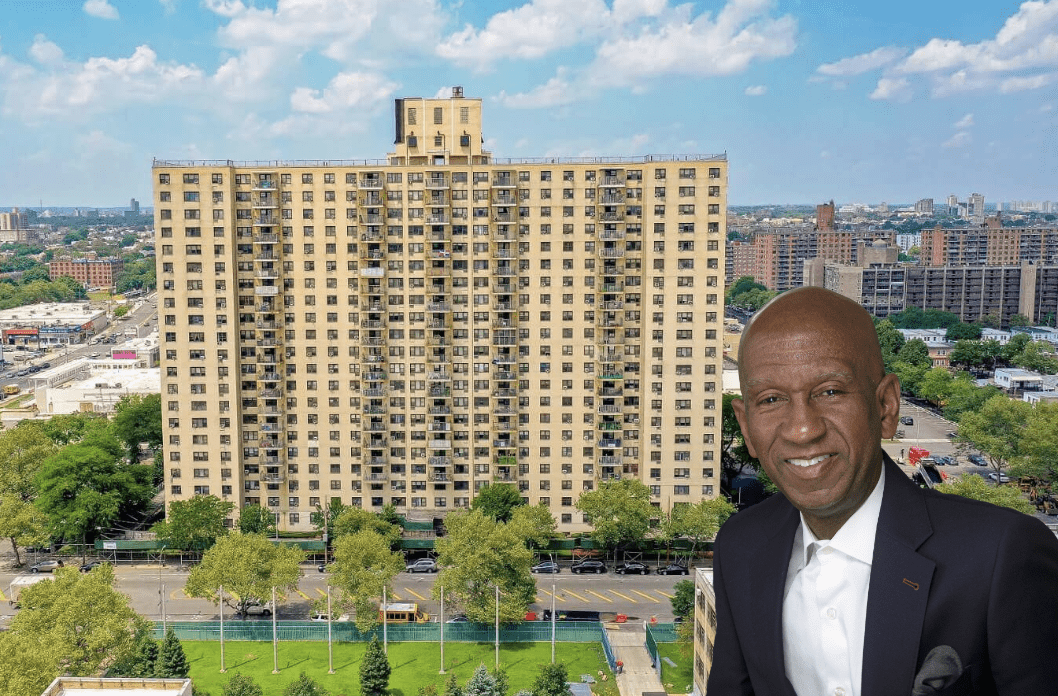

Established in 2019 by James H. Simmons III, Asland Capital Partners is a New York City-based real estate investment firm focused on urban renewal and workforce housing.

Over the past ten years, Asland has committed more than $700 million in equity to projects that involve adaptive reuse, workforce housing, and affordable multifamily residences.

In this interview, James offers his insights on current market trends, investment strategies, and valuable advice for aspiring real estate professionals.

What inspired the formation of Asland Capital Partners?

Asland was formed after I spent 17 years at Apollo Global and Ares Management, managing a series of institutional real estate private equity funds and separate accounts.

As both firms grew and matured, they were no longer the small firms that resembled start-up alternative investment companies. Asland was formed to replicate the success of those accomplished investment managers.

It was also created to establish a firm that reflects an entrepreneurial and nimble vision and values, with the aim of benefiting the team that embarked with me on this journey to launch the enterprise five years ago.

It’s our goal to make Asland the preeminent fiduciary of our client’s capital and to provide our residents with a world-class living experience.

What key market insights and trends are you observing, particularly in the affordable housing sector, and how do you anticipate these trends shaping future investment strategies?

There has been a longstanding supply and demand imbalance within the affordable housing sector. Nearly every large city and small town alike is struggling to provide adequate housing opportunities for its teachers, police, nurses, and service workers.

To help solve the problem, municipalities have emphasized implementing programs and policies to retain and create affordable housing alternatives including middle-income/workforce housing through very low-income housing for the most vulnerable.

Despite the concerted effort of elected officials and housing agencies, the cost of construction materials, labor, and the lack of availability of developable land limit the production of additional housing units.

Furthermore, the long lead time and predevelopment expense of building any real estate development in high-cost domiciles further complicates the situation.

What advice would you give to aspiring professionals looking to make a positive impact in the real estate industry?

Be the best that you can be at whatever you endeavor to do. Opportunity finds those who match talent with dedication, desire, and determination. Real estate is one asset class that touches all of our lives daily including where we live, work, and play.

It is also a career that can be rewarding in many ways including providing much needed shelter and affordable housing, positively changing neighborhoods for the better, and giving professionals a path to wealth creation for themselves and the communities that they invest in.