-

-

Fashion tech startup The Folklore, founded by Amira Rasool, has secured $3.4 million in seed funding. The fresh capital brings their total…

More -

Atlanta-based startup Cookonnect is whipping up a recipe for success, having recently secured a $1 million pre-seed funding round from Los Angeles-based…

More

News & INTERVIEWS

Two Black-owned breweries, Full Circle Brewing Co. and Crowns & Hops Brewing Co., have announced a groundbreaking strategic alliance aimed at transforming…

MoreTraditional real estate transactions are slow and expensive due to a complex and outdated process. Sparen, aims to revolutionize the industry by…

MoreAI Squared, a company empowering organizations to harness the power of AI, today announced a successful $13.8 million Series A funding round.…

MoreDiagon is a company that’s redefining the way manufacturers find and purchase equipment. They offer a next-generation procurement platform that streamlines the…

MoreFashion tech startup The Folklore, founded by Amira Rasool, has secured $3.4 million in seed funding. The fresh capital brings their total…

MoreAtlanta-based startup Cookonnect is whipping up a recipe for success, having recently secured a $1 million pre-seed funding round from Los Angeles-based…

MoreBlack Owned Sleepwear and Loungewear Brands

When it comes to comfort and style, Black-owned sleepwear and loungewear brands are taking the industry by storm. From luxurious fabrics and…

MoreAs spring sunshine warms the days, it’s the perfect time to shed those winter boots and update your footwear wardrobe. Look no…

MoreAs the sun peeks out and the days get longer, it’s the perfect time to refresh your wardrobe with some spring staples.…

MoreBusiness Topics

Mark Dusseau’s journey through the foster care system has instilled in him a deep commitment to social impact. His company, Dusseau and…

MoreThe Corporate Transparency Act (CTA), passed in 2020, has stirred up significant discussion and some confusion regarding its implications for business owners,…

MoreAs the Baby Boomer generation prepares for retirement, a vast, untapped potential emerges: established, profitable businesses seeking new ownership. This presents a…

MoreMoney

14 Ways to Increase Your Financial IQ

Building a strong financial IQ is critical, yet a significant portion of the global population faces challenges in this area. This lack…

MoreIn the world of finance, the adage “it takes money to make money” often rings true. For the ultra-wealthy, one of the…

MoreFrom the Bipartisan Infrastructure Law to major industry deals like Blackrock’s $12.5 billion acquisition of infrastructure investment firm Global Infrastructure Partners, several…

MoreLifestyle & Culture

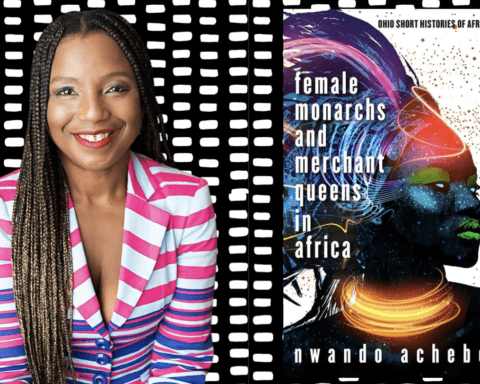

For centuries, the narrative of African leadership has been dominated by male figures. But the book, “Female Monarchs and Merchant Queens in…

MoreFor too long, the image of the cowboy has been a singular one – a white man on a horse, conquering the…

MoreFor over five decades, Bernard and Shirley Kinsey, alongside their son Khalil, have woven together a remarkable tapestry of African American history…

More